Consolidation in the clinical research industry may disrupt the supply chains of top pharmaceutical companies. We look at the impending risks and key mitigation strategies.

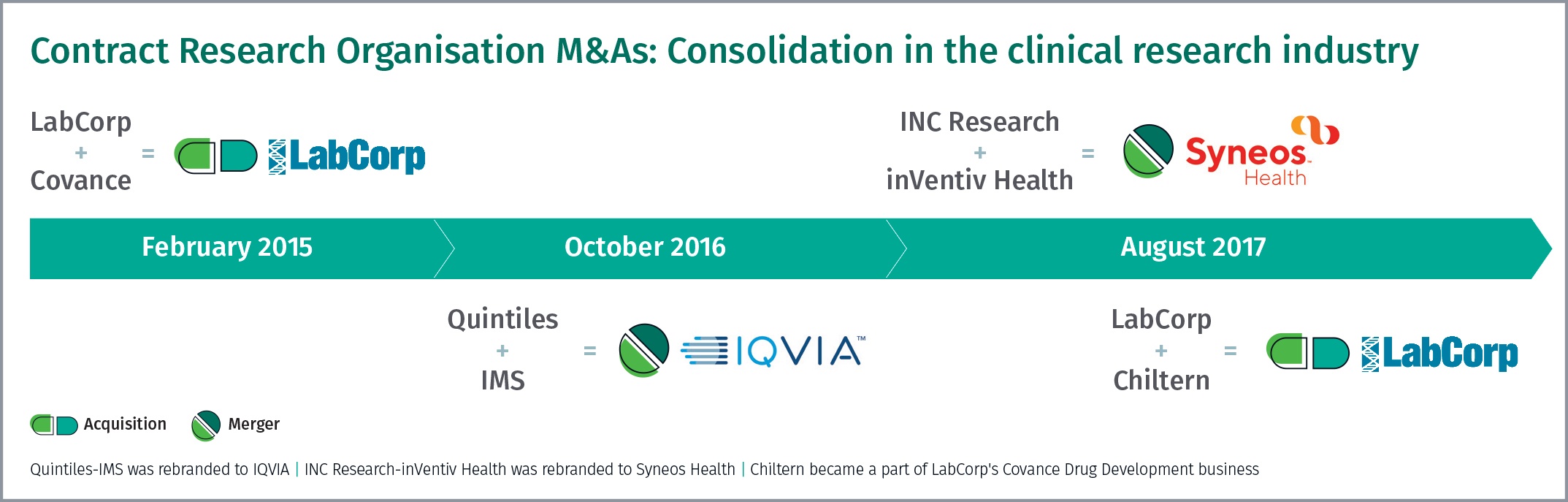

Traditionally, Contract Research Organisations (CROs) have been classified into large, mid-size and small – based on their revenue. In recent years, large CROs have been combining to form ‘mega CROs’, which have a revenue of >$4bn (almost double that of large CROs).

What was initially observed as a couple of isolated deals between Contract Research Organisations (CROs), has now converged into a firm trend and this consolidation is going to have implications for pharmaceutical companies’ supply chains in the future.

This consolidating market has started to cause ripples in the pharmaceutical industry, particularly the top end of the market. Here we address the impending risks for big pharma procurement managers.

Risk #1: Supply continuity

Combined entities have a propensity to get more efficient and leaner, by trimming down any instances of overcapacity, and this pattern is being seen among CROs. In 2017, LabCorp’s Covance Drug Development business announced plans to close its Evansville Lab and lay-off 100 employees, and in preparation for a planned sale, Parexel announced it would be cutting 1,100 to 1,200 jobs worldwide (the company was acquired by Pamplona Capital Management in a $5bn deal).

This consolidation and trimming down of inefficient operations reduces overall capacity in the market, which is likely to affect pharma companies with stable demand and heavy reliance on CROs. Almost 80% of big pharma’s clinical research spend is consolidated with mega CROs. These pharma companies have to continue working with mega CROs, but a consolidated market implies that the bargaining power is shifting towards the supplier. With suppliers getting leaner, procurers are staring at what we call a ‘capacity risk’. All pharma giants are fighting for that same capacity, and that’s where the mismatch is expected in the future.

Mitigation Strategy: Strategic partnerships

Entering long-term contracts with a guaranteed volume of work is one of the key mitigation strategies that pharma companies can adopt to protect themselves from potential capacity risk. Long-term strategic deals involve guaranteed volumes, guaranteed number of clinical trials and a regular stream of work. Such deals ensure that the partner CROs’ capacity is booked well in advance, and both the pharma company and the partners can plan ahead; if there is a foreseeable capacity risk, the CROs can equip themselves with the requisite resources in time.

Traditionally, research outsourcing has happened on an ad-hoc basis. But over time, long-term contracts, like the 10-year deal between Sanofi and Covance, have become a more typical feature in the life sciences space. It is viable for big pharmaceutical companies to enter multiple strategic deals and hedge the continuity risks. Pfizer, for example, has formed strategic partnerships with a total of four CROs (Icon, Parexel, PPD, inVentiv Health), as opposed to engaging with nearly 20 vendors, something the $52bn pharma company has done previously.

Risk #2: Cost

A major impact of consolidation within an industry is on the negotiation power of the buyer and the supplier. The buyer loses its bargaining power because of a lack of options; and the supplier takes the position where it can increase its pricing owing to very little competition from the market.

The largest pharma companies (revenue >$40bn) form the preferred clientele of mega CROs simply because of their volume and continuity of work, and for this reason, won’t find it hard to negotiate with mega CROs. The biggest impact could be felt by those in the revenue bracket of $10bn – $25bn – companies like Shire, Biogen, Amgen, Bristol-Myers Squibb. There is a risk that this segment of pharma companies may not retain their key account status as they become less attractive customers for mega CROs in the future.

Mitigation Strategy: Price controls and looking at alternative options

Introducing price controls in long-term contracts is one way of mitigating the cost risk. A strategic partnership tends to be a combination of transactional and strategic services. It is advisable for pharmas to introduce pricing controls for certain tactical services in the SLAs. For instance, pharma companies can procure services of research associates from CROs on a pre-negotiated price for a relatively long period. It is also feasible to agree on a price for transactional tasks such as clinical monitoring or data management.

Currently only 20%-40% of the top 10 pharmas’ spend is designated to the mid and small sized CROs, and this is where they may find opportunities. Firstly, they offer credible alternative suppliers: when outsourcing their research, organisations should ask whether there is a smaller supplier that can offer services on par with the mega CROs. The smaller CROs have specialised in niche areas like early phase research, orphan drug research and orphan drug diseases – and this is where pharma companies could partner with them and cut costs without compromising quality. Secondly, the presence of alternatives also allows pharmaceutical companies to use them as bargaining chips when negotiating deals.

Risk #3: Quality of services

Due to the importance of big pharma to their businesses, CROs won’t let the quality of their services drop for those at the top of the market. The risk is to the big-but-not-the-biggest pharma companies. Since mega CROs are expected to have a capacity deficiency and shorten their key accounts list, they may not deploy their best resources to this segment of clientele; these pharma companies should be alert to any changes.

Mitigation Strategy: Vigilant look at resources

Pharmaceutical companies must keep a vigilant eye on the talent working on their projects, including their experience, qualifications and skillsets, and especially ensure that they retain the most experienced CRO personnel assigned to their accounts. Including quality-of-talent requirements within SLAs may be a good first step to prevent any potential future threat.

The way forward

We forecast that the trend of consolidation in the Contract Research industry will continue. We wouldn’t be surprised to see some of the remaining large CROs come together to form another giant like IQVIA or Syneos Health, or an individual company go on an acquisition spree of smaller specialised CROs to boost its market share.

So pharmaceutical companies can expect more mega CROs…which implies more risks. For category managers, timely and tailored market intelligence is key to being able to effectively manage this scenario. Proactive tracking of activities of existing suppliers, competitor strategies, and the overall CRO market, can generate invaluable insights to inform decision-making, purchasing strategies and risk mitigation. In addition, intelligence on alternative suppliers such as small and mid-sized CROs, and the patent landscape, can provide effective levers for contract negotiations.

To find out how The Smart Cube helps Life Sciences businesses stay ahead, please read about our intelligence and analytics solutions or get in touch. We can help you understand and anticipate the forces and changes influencing your critical procurement categories today and beyond.

(With additional inputs from Varun Mahajan, Assistant Manager, Life Sciences)